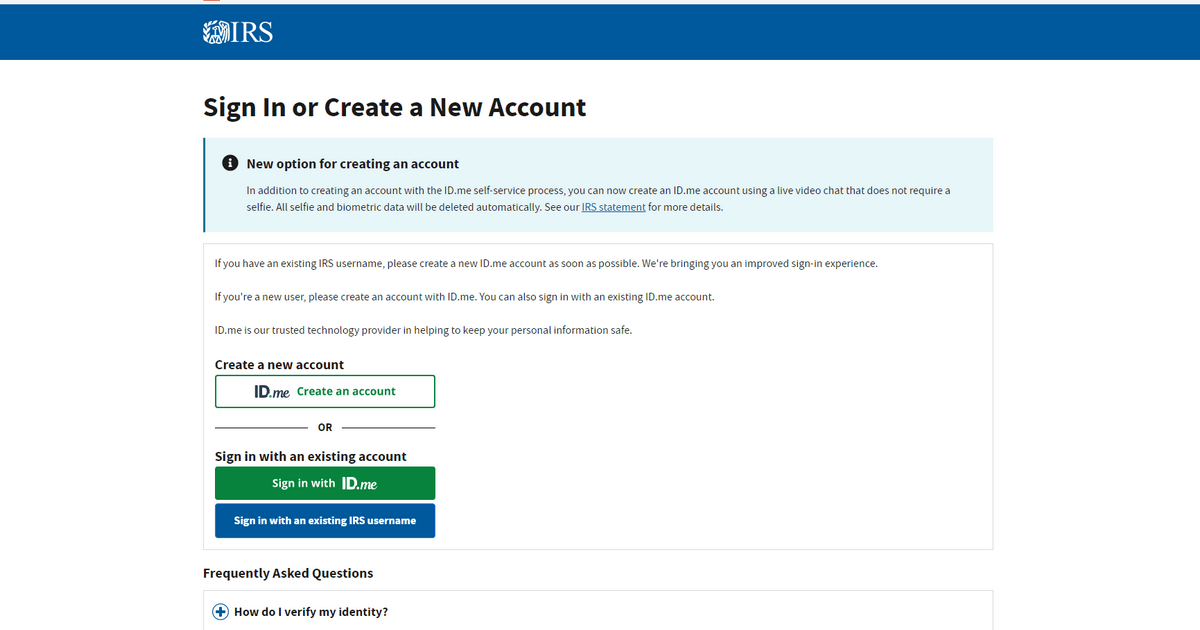

You can contact the IRS directly to establish or update your account. You can also visit the IRS website to find out more about what services are available to you. To be an existing IRS user, you must be a taxpayer and have your individual identification number (INVoice). You will need to request an account from your employer or the IRS. If you want to be an existing IRS user, you can use the IRS online user interface. Internal Revenue Service – Wikipedia.

View Your Balance

To view your balance, open the “My Account” page on our Internal Revenue Service website. At the top of the page, click on the “View Balance” link. Enter your account number and click on the “View Balance” button. You will see the current balance of your account, as well as a history of your transactions.

Make and View Payments

To make a payment, open the Payments tab and select the type of payment you want to make. Make a payment from your bank account or by debit/credit card. You can also make a guest payment without logging in You can make a payment by selecting a payment method from the list, or by entering the amount you want to pay. The payment will be processed and you will be notified when it is finished.

The Benefits of Cost Accounting in Project Management- Click Here

View or Create Payment Plans

Create a payment plan to make payments over time. Click on the ‘Make a Payment’ button. Select the ‘Payment Plans’ tab. You will be able to see any active payment plans that you may have. To create a new payment plan click the ‘Create a Payment Plan’ button. Before creating a new payment plan, you will be able to select if the payment plan is for ‘Tuition’ or ‘Other Charges’.

Click on ‘Create Payment Plan’ and fill out the form with the amount you wish to pay and the frequency of the payments. The minimum amount per payment is. Click ‘Continue’ to review the plan. Click ‘Submit’ to confirm the payment plan.

IRS Manage Communication Preferences

You may manage your communication preferences by clicking here. To unsubscribe from all communications, We reserve the right to modify this Policy at any time. If we modify this Policy, we will post the modification on the Site, to the extent permitted by law. By continuing to access or use the Services after we have posted a modification to this Policy, you are indicating that you agree to be bound by the modified Privacy Policy. If the modified Privacy Policy is not acceptable to you, your only recourse is to cease using the Services. When you create an account on our site, we will send you an email to notify you of any new account activity or account changes.

irs Access Tax Records

- (1) View key data from your most recent tax return, including your adjusted gross income, and access transcripts (2) View impact payment information (3) View information on child tax credit prepayments (4) View digital copies of select IRS notices

IRS View Tax Pro Authorizations

Consult any requests for authorization from tax specialists

Approve and electronically sign your tax attorney’s power of attorney authorization and tax information

Canada has 10 lakh job vacancies! Full list of postings that can get you PR – Click Here

IRS Accessibility

The IRS is committed to providing equal access to our web content for all visitors. If you have difficulty with any part of our website, please call the Taxpayer Advocate Service at 1–877–777–4778 (toll–free) or TTY/TDD at 1–800–829–4059 (toll–free) Monday through Friday, 7 a.m. to 7 p.m. local time (Alaska & Hawaii follow Pacific Time). You can also call 1–800–829–4059 (toll–free) Monday through Friday, 8 a.m. to 8 p.m. Eastern Time if you are hearing impaired. A few of the files on our site are available in Portable Document Format (PDF). To view and print PDF files, you need the Adobe Acrobat Reader. Download the free Adobe Reader.

Work from home Jobs l Earn up to $.400 PM I Data Entry Operator l Home based work Click Here

IRS Other ways to find your account information

- You can request an account transcript by mail.Note that each account statement covers only one fiscal year and may not show the most recent penalties, interest, amendments, or pending actions.

- If you are a business or individual who submitted a Form other than 1040, you can obtain a transcript by submitting Form 4506T, Request for Transcript of Income Tax Return.

- Find more assistance